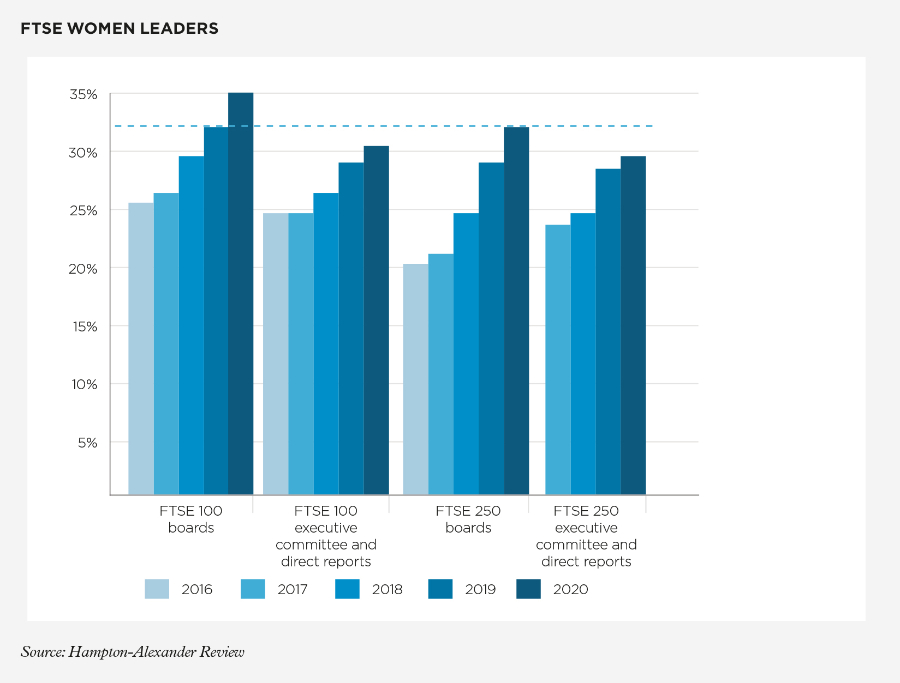

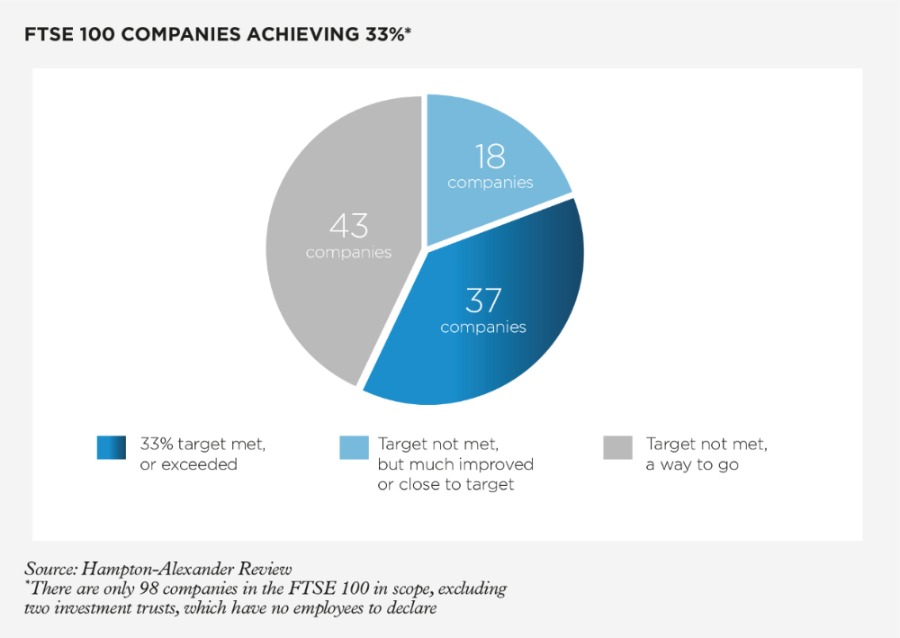

UK Plc has earned a big tick for gender diversity, according to a report published in February 2021. The fifth and final report of the Hampton-Alexander Review, an independent review led by the business community and supported by the UK government to increase the number of women on FTSE 350 boards, finds that the country’s 350 biggest listed companies have met the target set for them in 2016 – that women should hold 33% of board seats by the end of 2020. As it turned out, the total was 34.3%, up from 21.9% female directors when the exercise began. Also, the report shows that in 2015, there were only seven companies in the FTSE 100 that had five or more women on their board. In 2020 there were 26 companies, which is a pretty dramatic shift.

This is encouraging, but there are caveats. Female executive directors are still relatively rare and progress towards gender balance in senior management has been slower. The review examined female representation in 23,000 leadership roles in the FTSE 350, including main board directorships and the two management levels immediately below. It did not include formal targets for senior management jobs, but when it started collecting data in 2017, 24.5% of these posts were held by women. This increased to 29.4% by December 2020.

The differing rates of progress in boardrooms and executive suites tells the real story here. Increasing representation of women on main boards is easier than in the executive ranks because companies can tilt their recruitment for fixed-term, non-executive directorships towards female candidates and so reach the target more quickly. Shifting the gender balance decisively among senior managers is a more gradual process. This inconvenient truth holds important lessons for anyone concerned about the corporate world’s performance on environmental, social and governance (ESG) issues.

Gender balance, especially in leadership roles, is an area of social impact – the S in ESG – where many believe asset managers should be pushing the companies that they invest in to improve. But if fund managers cannot show good progress towards gender balance in top roles themselves, how can they hope to sound credible when they lean on their portfolio companies to up their game?

This is why it is important to examine how asset managers are performing on gender balance – as influential voices at the top tables of British business, they can potentially have an outsized influence on how quickly progress is made across many industries. Especially if they are seen to be leading by example.

"Firms have a lot of male incumbents and the natural rate of turnover is often slow"

Luckily, another reporting exercise, the Treasury’s Women in Finance Charter, which asks firms in the financial services sector to pledge for gender balance, sheds light on this question. The charter, launched in 2016, has just published its 2020 review of how its 209 signatories are performing.

Again, the signs are encouraging: 70% have met or are on track to meet the targets they have set themselves for representation of women in senior management. These targets typically range from 25% to 50%, although it is puzzling to see Mizuho Bank among the success stories with a target of just 5% to 10%. The Treasury and National Savings and Investments are among the select group that have achieved 50% female representation in senior management – illustrating the importance of leading from the front if you want to be taken seriously.

But if you drill down into the data from the charter’s signatories by sector, the performance of asset managers lags some way behind other areas of financial services. The 2020 review finds that investment management companies on average have 28% of their senior management roles filled by women, unchanged from the previous year. That puts them second to bottom of the pile. Only global/investment banking has a smaller proportion of women in top jobs (25%). Perhaps more of a concern is that investment managers have one of the lowest average targets for female representation in senior management, at 33%. The average target across all financial services is 36%, and many sectors aspire to 40% plus.

Shifting the dial on gender balance in senior jobs is difficult. Firms have a lot of male incumbents and the natural rate of turnover is often slow. Equally, talented rising stars of both sexes aspire to top jobs and companies must be seen to manage these appointments fairly and on merit. And improving ESG performances (including gender balance) is only one among many priorities they must consider. They want to attract and retain the best talent, and maximise customer satisfaction and financial performance. Progress on gender balance is most likely when it aligns with the company’s other goals.

Asset management companies are every bit as exposed to these challenges as any other type of company. It is well documented that women are particularly underrepresented in the ranks of senior portfolio managers, who make the investment decisions.

This matters a great deal because if asset managers are to operate as credible advocates for greater gender balance at the top of UK Plc (and racial and social diversity more generally), then they need to do a better job of leading by example. Otherwise it’s yet another case of ‘do as I say, not as I do’.